Institutional

Our business model

As the oldest financial institution in Paris, Crédit Municipal de Paris has demonstrated the robustness of its financial model for almost four centuries.

A simple credit activity for private individuals, a loan against the pledging of an object of value

Crédit Municipal de Paris (CMP) is a credit and welfare institution. Our lending to private individuals is based solely on the pledging of valuables by our customers. These are independently appraised by commissaires de justice (formerly judicial auctioneers). We lend at least 50% of the estimated value of the pledge, with a limit set by the French Monetary and Financial Code at 80% for gold or platinum items and 66% for other items. In the event of default on the loan, the items held by the CMP are sold at auction.

Our refinancing comes from the outstanding savings we collect from individuals and from the financial markets.

Pawnbroking is a simple, virtuous system of lending to individuals, monopolized by municipal credit unions.

Given the value of the loan collateral, Crédit Municipal de Paris' cost of risk is negligible. The main purpose of our cash management activity is to provide Crédit Municipal de Paris with a cushion of liquidity to absorb external shocks.

A financially solid establishment

Crédit Municipal de Paris is publicly owned, with the City of Paris as our sole shareholder. It is particularly well rated by the rating agencies, with Standard & Poor's awarding it an AA- rating in November 2023(see press release). The rating of CMP, whose debt is guaranteed by the City of Paris, is therefore higher than that of the vast majority of French financial institutions.

Authorized by the European Central Bank, Crédit Municipal de Paris is supervised by the Autorité de contrôle prudentiel et de résolution (ACPR) and is subject to all banking and prudential regulations applicable to credit institutions.

Our accounts are certified by two statutory auditors (KPMG and Grant Thornton today), and our establishment deploys a rigorous internal control policy in line with regulators' expectations (risk and compliance management, permanent and periodic control, combating money laundering and the financing of terrorism, IT security, personal data protection). The financial courts (Chambre régionale des comptes d'Ile-de-France) may also audit our company.

Crédit Municipal de Paris' financial structure is particularly solid.

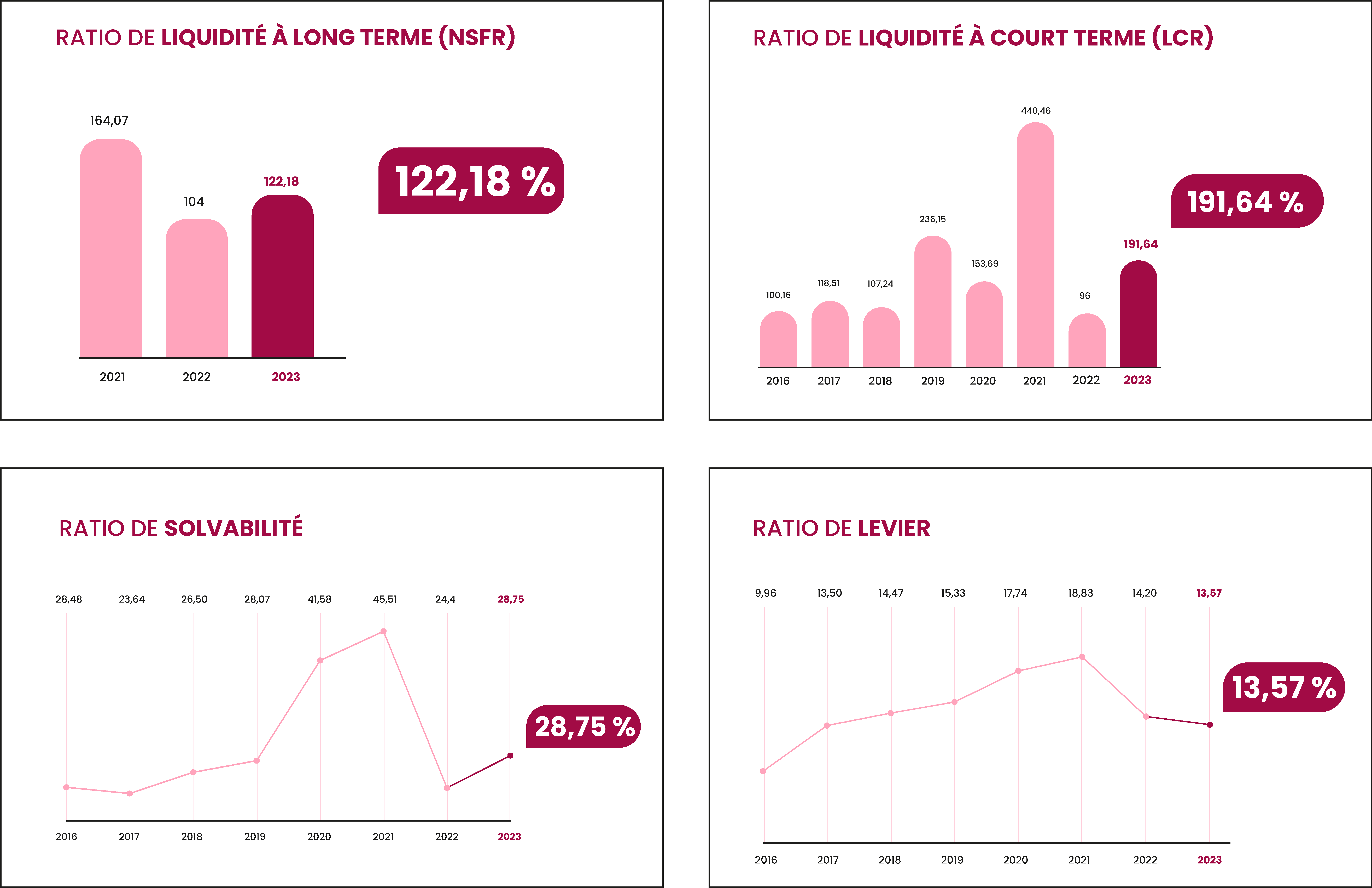

We are well within the industry's regulatory ratios.

- Long-term liquidity ratio (NSFR) achieved by the end of 2023: 122.18%

(for a minimum requirement of 100%) - Short-term liquidity ratio (LCR) reached end 2023: 191.64%

(for a minimum requirement of 100%) - Leverage ratio achieved at December 31, 2023: 13.57%

(for a minimum requirement of 3%) - Solvency ratio achieved at December 31, 2023: 28.75%

(for a minimum requirement of 10.5%)

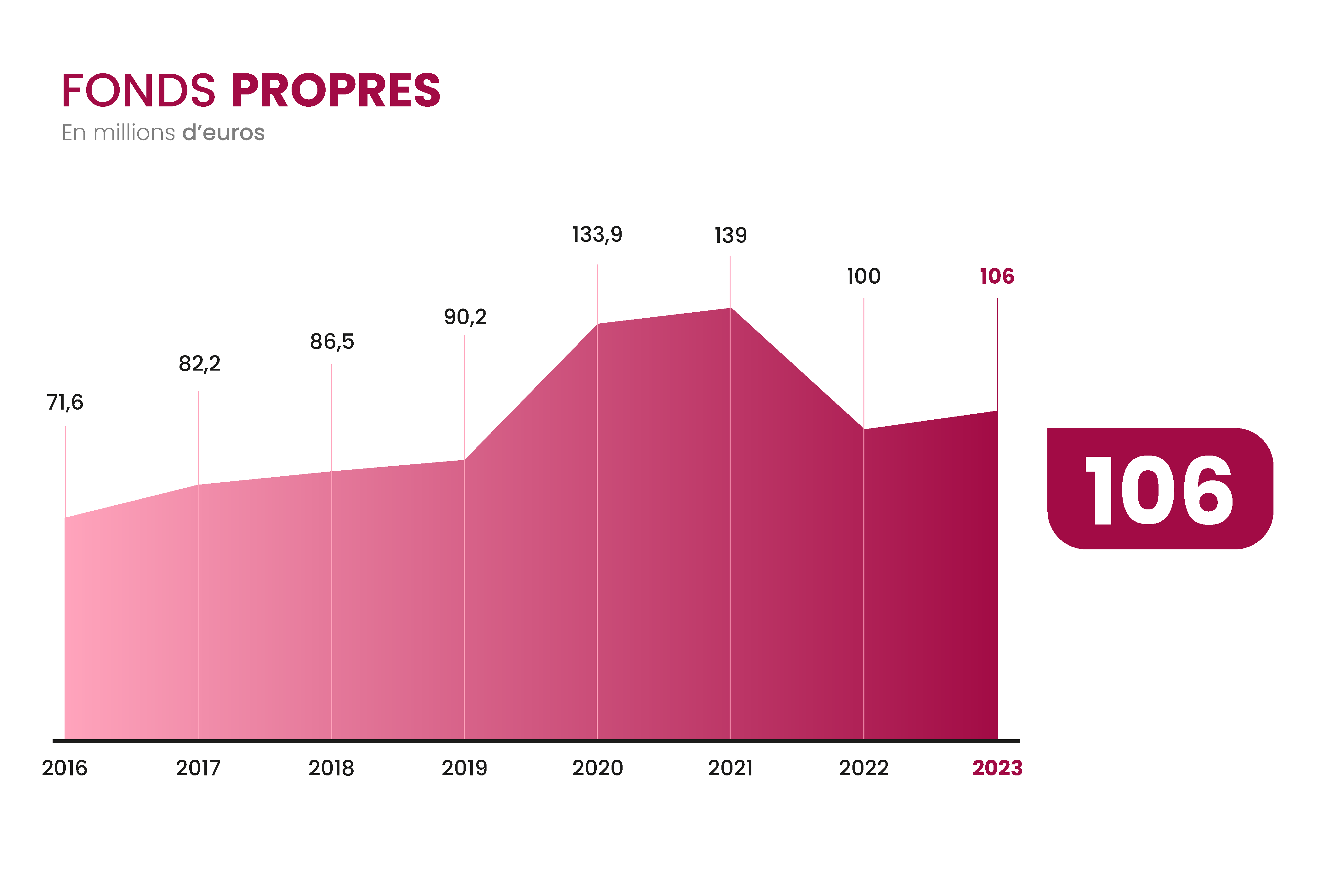

CMP's high level of equity has also enabled it to return €42 million to its shareholder in 2022, the amount of the recapitalization carried out in 2015 by the City of Paris.

CMP also owns a 25,000 m² property complex in the Marais district, right in the heart of Paris.

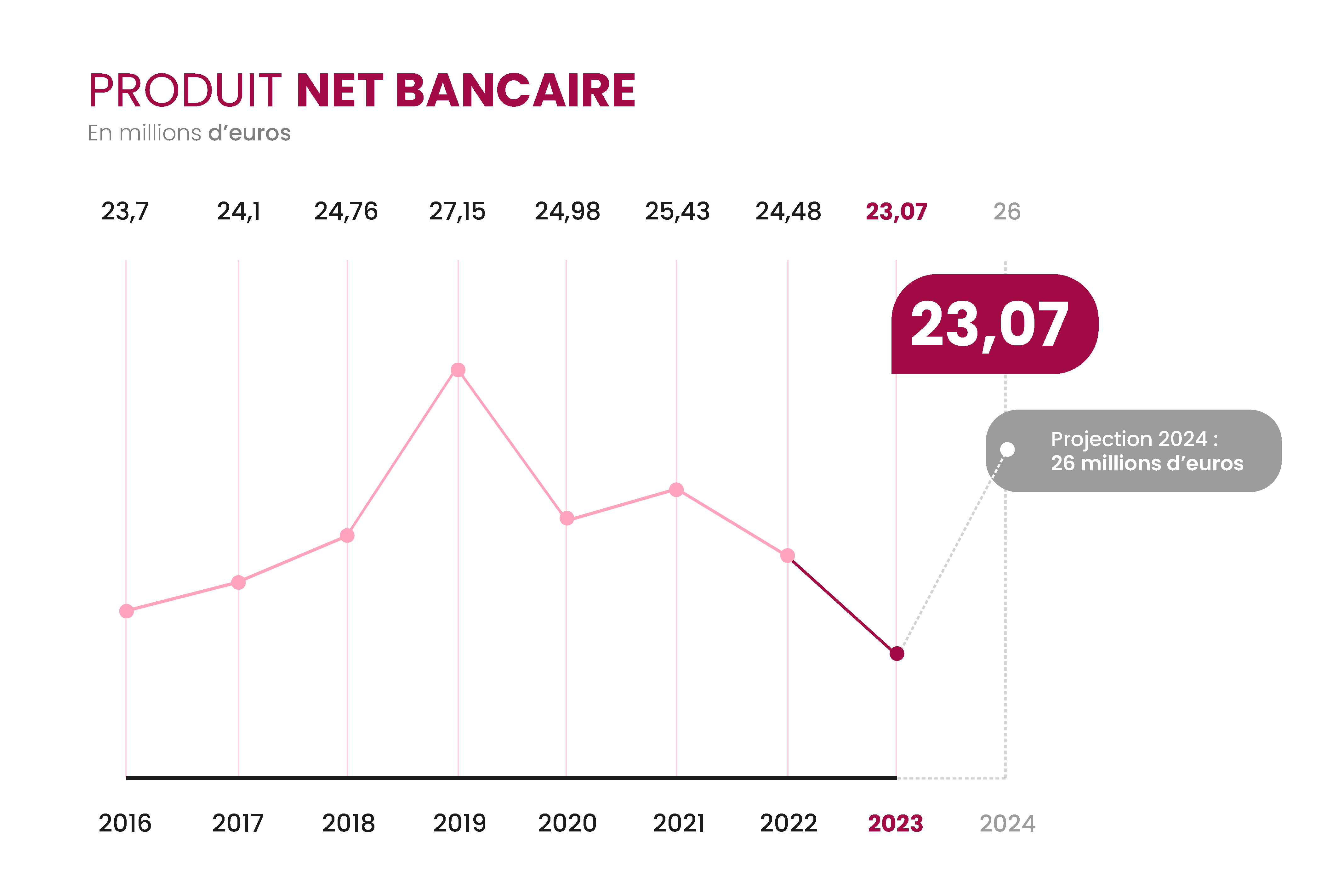

Its diversified revenues (lending activity, auction sales, rental income, income from its art and valuables conservation activities under the CC ART brand) bolster the structure of its NBI (the "sales" of a credit institution).

The squeeze on NBI in 2022 and 2023 reflects the surge in refinancing costs for financial institutions in France, and our decision to pass on only about half of this increase in customer lending rates.

The outlook for 2024 suggests a very significant rebound in CMP's financial performance in 2024 and beyond, in line with the financial targets set out in our Herakles strategic plan.

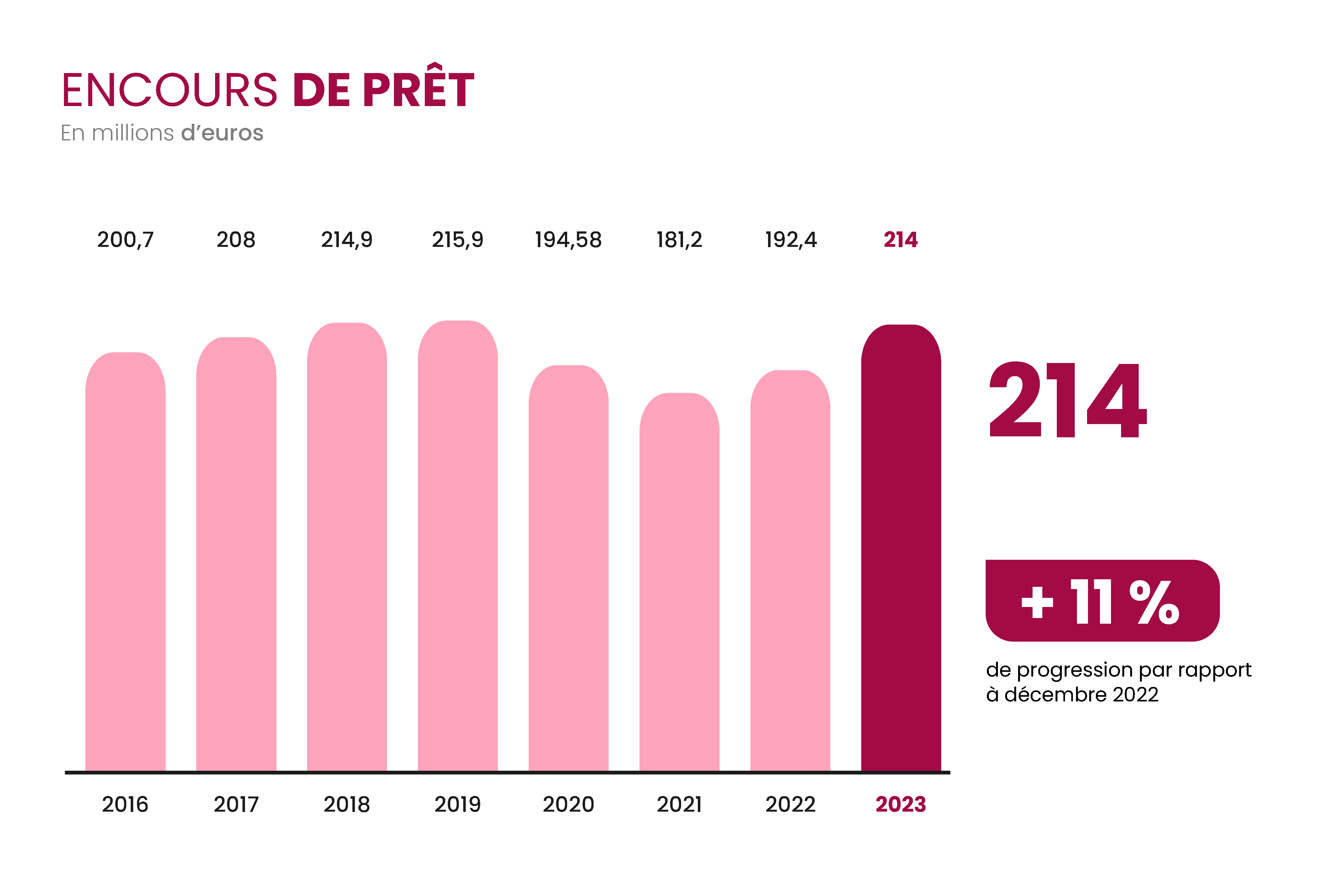

After a drastic fall during the health crisis, CMP bank production has recovered strongly since 2022 (+9%) and is up by 8% in 2023, so that outstanding pawn loans are now at historic highs.

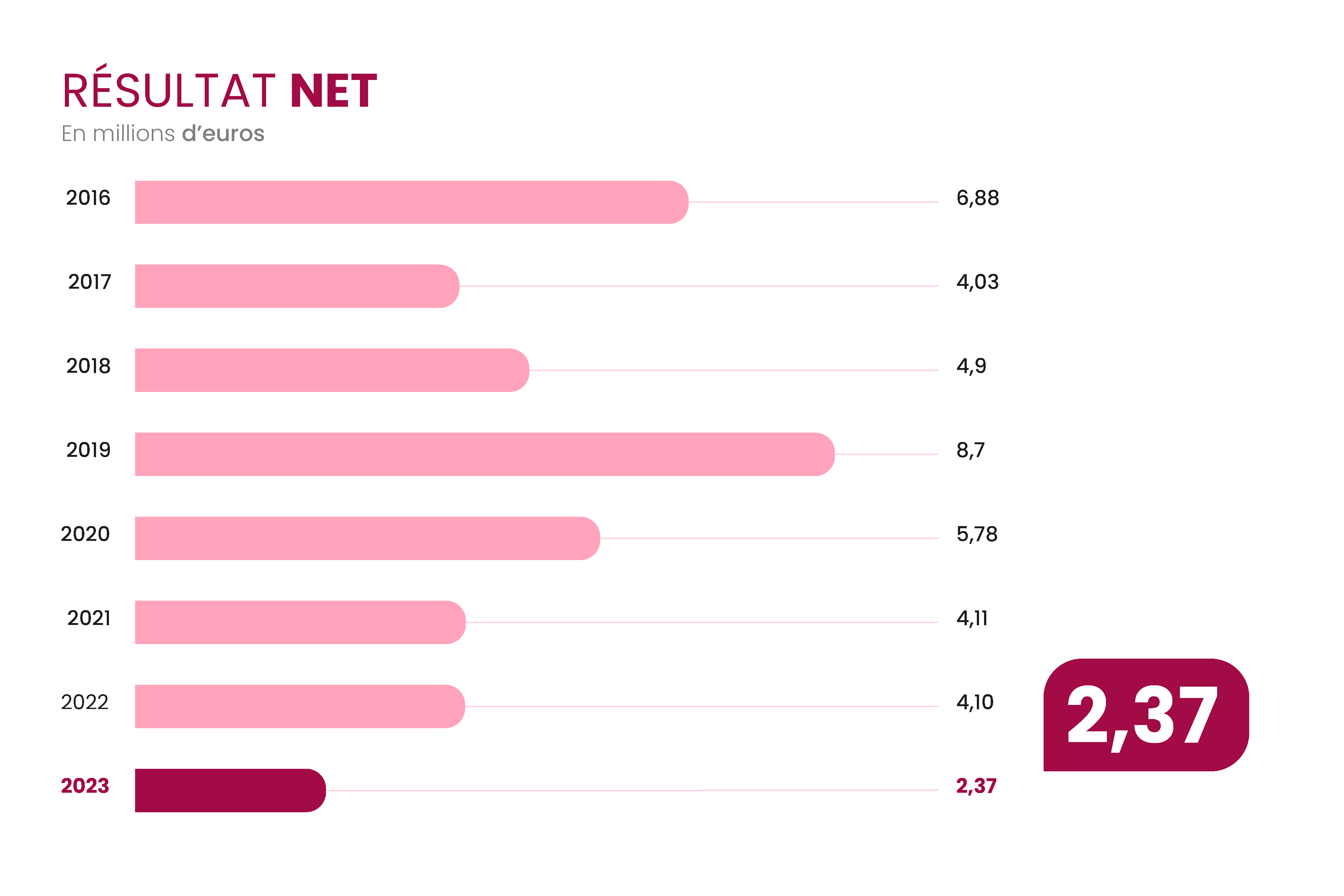

The CMP's financial strength is finally evident in the sequence of net profits achieved since 2016. They serve a triple purpose: to finance the CMP's investment plan (16 M€ planned from 2021 to 2025 for digitization and real estate investments), to strengthen the establishment's equity capital, and to ensure the annual distribution of a fraction of profits to partners working in the social or cultural fields.

An ethical and transparent bank, a pillar of social finance in France

Crédit Municipal de Paris has a rigorous policy of preventing conflicts of interest. This also applies to members of our governing body, the Conseil d'Orientation et de Surveillance (COS), who are prohibited from using the various services and products offered by our establishment (loans, auctions, savings, custody).

The CMP's management expenses (telephony, travel, miscellaneous expenses, etc.) are monitored on a quarterly basis, audited and published in our annual report. All new staff at the CMP receive training in professional ethics and the fight against sexist and sexual violence. Today, our establishment is a pillar of social finance in France.

If 10% of pledged items are auctioned off, the "bonus" mechanism enables us to return €6 million a year to our borrowers (the "bonus" is the capital gain realized on a sale between the auction price and the sums owed to the CMP).

In 2018, our establishment launched the Paris Partage passbook, a Finansol-labeled shared savings product that offers savers the opportunity to donate part of the interest generated to associations: more than €100,000 was donated to them in 2023!

As part of our Herakles strategic plan, we have undertaken to donate at least 10% of our profits to charitable organizations each year: In 2023, this social golden rule enabled us to donate over €680,000 to finance a Secours Populaire grocery store in the 13th arrondissement of Paris, the opening of a bookshop in the 20th arrondissement with Emmaüs Coup de Main, and to support the Fondation des Femmes in its fight against violence, in particular by making a relay apartment available free of charge to women victims of violence.

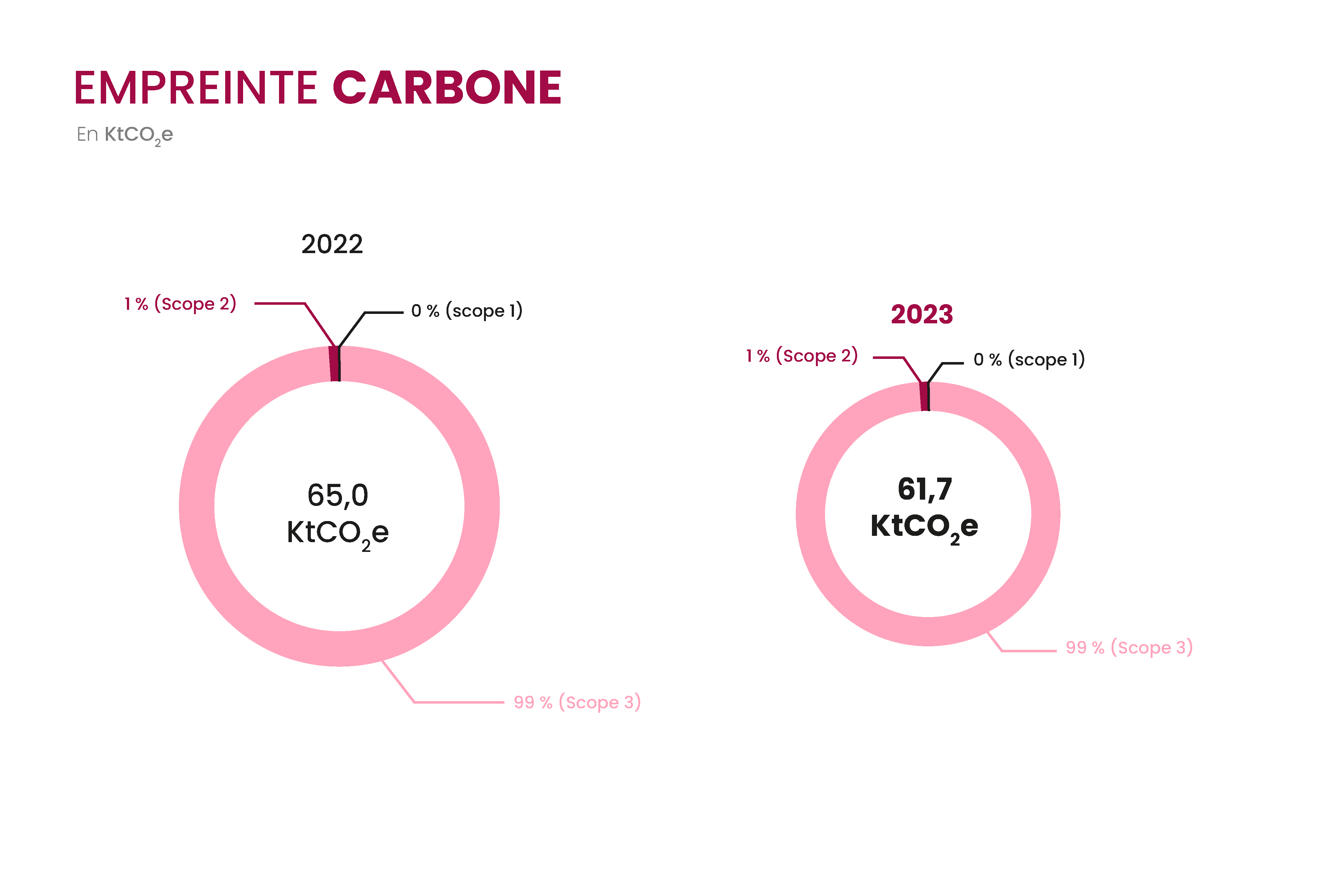

A committed lender since 1637, CMP has finally chosen to adopt full transparency regarding the amount of CO² emissions generated directly or indirectly by its activities: every year, we calculate our carbon footprint and publish the results on our website and in our activity report.

Scope 1 = the company's direct emissions (mainly fuel consumption + emissions linked to refrigerant gases)

Scope 2 = the indirect emissions linked to the energy consumed in carrying out its activities (=indirect emissions linked to electricity or heating consumption [emissions from power stations producing the energy consumed ])

Scope 3 = the other indirect emissions generated by the establishment upstream and downstream in carrying out its activities (purchases of products and services, transport of goods, immobilization of goods, waste generated, business travel, transport of customers and visitors, emissions from customers or entities to which money has been lent...)

Finally, we believe in collective intelligence, and that the only wealth is in men and women: our establishment has equal representation of men and women (51% women, 49% men), as does its management committee; we devote over 2% of our payroll to professional training for our employees, who have the opportunity, when they wish, to take advantage of a volunteer day paid for by their employer to give a little of their time to the public-interest association of their choice.

"In 2023, against a backdrop of soaring interest rates, Crédit Municipal de Paris, like other financial players, had to question its vision of resilience and translate it into action."

Frédéric Mauget, General Manager

Financial report 2023

"The current financial climate is putting all social and economic players to the test. However, Crédit Municipal de Paris has managed to consolidate all its activities and maintain its role as a resource for all Parisians.

Paul Simondon, Vice-Chairman of the Orientation and Supervisory Board, Deputy Mayor of Paris in charge of finance, budget, green finance and funeral affairs

Previous years

Risk report

The aim of Pillar III is to establish market discipline through a set of reporting requirements. These requirements, both qualitative and quantitative, improve financial transparency in the assessment of risk exposures, risk evaluation procedures and capital adequacy.

Do you have any questions?

Please contact us!

Press Department

55 rue des Francs-Bourgeois,

75004 Paris