News

Crédit Municipal de Paris doubles savings account rates

Crédit Municipal de Paris offers several solidarity savings products for individuals. On February1, all rates will be increased. An important gesture for savers, which will also strengthen the social actions supported by these passbooks.

The Livret Paris Partage, a double solidarity product

Launched in 2018, the Livret Paris Partage is the first double solidarity savings account. It enables savers to invest from €50 to €50,000 at an attractive rate, while funding an important cause. Savers choose to donate 25%, 50%, 75% or 100% of their interest to one of three partner associations: Emmaüs Coup de Main, Siel Bleu or Agence du Don en Nature. The capital invested is used to finance the pawnbroker's social activities.

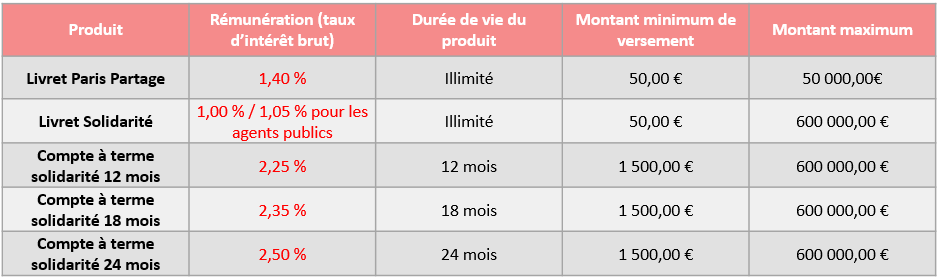

Crédit Municipal de Paris has decided to double the interest rate on this savings account, from 0.70% to 1.40%. " A good way for savers to earn more while giving meaning to their savings," explains Frédéric Mauget, General Manager of Crédit Municipal de Paris. " 22 million at the end of 2022, will enable us to finance our traditional social activity: pawnbroking ", he adds.

Increase for Livret Solidarité and Compte à Terme Solidarité passbook savings accounts

The increase is also significant for other Crédit Municipal de Paris savings products:

-

From February1, the Livret Solidarité will pay 1% gross per annum for investments of €50 to €600,000. The Livret Solidarité gives you free access to your money, and allows you to make withdrawals or deposits at any time, free of charge. The capital is fully guaranteed. Public-sector employees benefit from preferential remuneration.

-

The Compte à Terme Solidarité allows you to invest your savings for renewable periods of 12, 18 or 24 months, with interest of up to 2.50% gross. The funds are released in a single payment at the end of the contract, and the capital is fully guaranteed, for an investment of €1,500 to €600,000 excluding interest.

Secure, socially responsible investments

All three Crédit Municipal de Paris passbooks have been awarded the Finansol label, a guarantee of solidarity and transparency. Choosing to open a savings account with Crédit Municipal de Paris means savers can be sure of a secure, high-performance, socially responsible investment. Secure, because Crédit Municipal de Paris offers the guarantee of an establishment whose capital is 100% public. High-performing, because their new interest rates make these passbooks among the most attractive on the market. Solidarity-based, because outstanding savings enable the bank to pursue social initiatives, notably by financing pawnbroking.

Rates from February1, 2023: